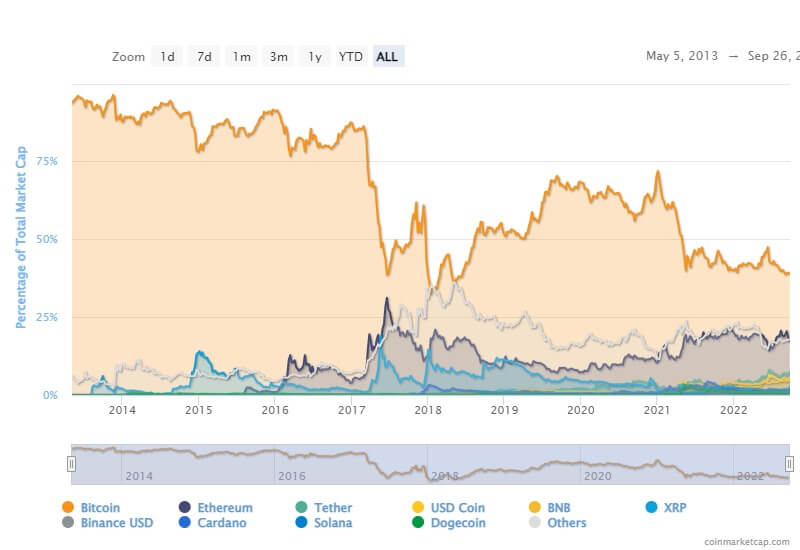

The inclusion of cryptocurrencies like Bitcoin, Ethereum, XRP, Solana, and Cardano in the U.S. strategic crypto reserve marks a pivotal moment for institutional and governmental involvement https://wlsgames.com/. This move has increased mainstream acceptance and provided additional credibility to digital assets.

This comes following an extended bull run for crypto that took place between the last quarter of 2024, and the first two months of 2025. Yet while other factors may be weighing on the minds of crypto investors right now, consider the root cause of the late 2024/early 2025 crypto rally: the specter of regulatory clarity.

After years of regulatory murkiness, regulatory clarity has started to take shape, and not just in the U.S. Yes, this was a major reason behind the aforementioned run-up in cryptocurrency prices. Following Donald Trump’s re-election as U.S. President last November, investors became extremely confident that the U.S. would soon implement clear-cut yet industry-friendly regulatory policies.

Assuming that latest macro uncertainties rocking the crypto market will ultimately come to pass, the arrival of regulatory clarity, and with it a further mainstream adoption of crypto as a store of value, medium of exchange, and as an institutional-grade asset class, strongly suggests the eventual return of a crypto bull market.

The U.S. Securities and Exchange Commission now shows more openness toward crypto regulation. It is backing new Bitcoin ETFs while establishing stablecoin guidelines. European Union’s MiCA regulations have also become fully operational to protect investors and build institutional trust in the sector.

Looking at a longer timeframe, BTC underwent nearly 14 weeks of consolidation at high levels before breaking down with increased volume. If there is no fundamental change in the environment, such as the Fed accelerating rate cuts, then the bottoming time should not be less than the high-level consolidation time, and may even be longer.

CoinRank is not a certified investment, legal, or tax advisor, nor is it a broker or dealer. All content, including opinions and analyses, is based on independent research and experiences of our team, intended for educational purposes only. It should not be considered as solicitation or recommendation for any investment decisions. We encourage you to conduct your own research prior to investing.

Looking at a longer timeframe, BTC underwent nearly 14 weeks of consolidation at high levels before breaking down with increased volume. If there is no fundamental change in the environment, such as the Fed accelerating rate cuts, then the bottoming time should not be less than the high-level consolidation time, and may even be longer.

CoinRank is not a certified investment, legal, or tax advisor, nor is it a broker or dealer. All content, including opinions and analyses, is based on independent research and experiences of our team, intended for educational purposes only. It should not be considered as solicitation or recommendation for any investment decisions. We encourage you to conduct your own research prior to investing.

However, overall, a favorable turn in the broader environment (such as Fed rate cuts and balance sheet expansion) is still needed; and recent events such as the Ethereum Foundation selling tokens and core developers leaving have caused community dissatisfaction, coupled with the rise of competitors like Solana, may weaken the positive impact of the upgrade. Although the testnet is progressing smoothly, if vulnerabilities or delays occur in the mainnet upgrade, it may trigger short-term selling pressure.

In the current high interest rate environment maintained by the Fed, the carry trade opportunities for long-term securities (such as US Treasuries) become more attractive, encouraging foreign investors to increase positions to lock in higher returns. Foreign investors tend to “buy long, sell short,” meaning increasing holdings of medium and long-term US bonds while reducing short-term securities. This strategy may reflect bets on the Fed’s future rate cut path: if rate cuts are delayed, long-term yields remain relatively stable; if rate cuts begin, long-term bond prices will benefit from declining rates.

Throughout 2025, SUI is predicted to trade between $2.44 and $8.80 based on SUI upward revised price targets (Oct 12th). Key drivers: institutional adoption and technological advancements. If market conditions remain favorable, SUI could experience significant growth.

The disjointed nature of blockchain ecosystems has long presented a significant roadblock to mainstream adoption. Each crypto network typically requires dedicated applications for basic use — a cumbersome user experience that limits broader participation.

Hedera Hashgraph is setting a new standard for enterprise blockchain adoption. Unlike traditional blockchains, Hedera utilizes a hashgraph consensus mechanism, allowing for high-speed transactions, unmatched security, and near-zero fees.

Throughout 2025, SUI is predicted to trade between $2.44 and $8.80 based on SUI upward revised price targets (Oct 12th). Key drivers: institutional adoption and technological advancements. If market conditions remain favorable, SUI could experience significant growth.

The disjointed nature of blockchain ecosystems has long presented a significant roadblock to mainstream adoption. Each crypto network typically requires dedicated applications for basic use — a cumbersome user experience that limits broader participation.

Hedera Hashgraph is setting a new standard for enterprise blockchain adoption. Unlike traditional blockchains, Hedera utilizes a hashgraph consensus mechanism, allowing for high-speed transactions, unmatched security, and near-zero fees.